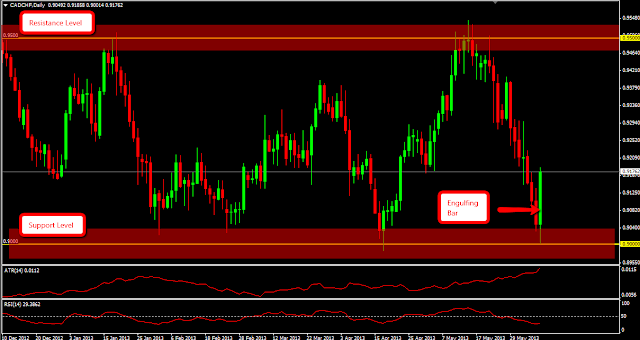

This is the original setup that I posted on Sunday night, with an inclination to go long on the break of the engulfing bar. I predicted continued bullish action from support at 0.9000.

My long was triggered yesterday and price moved in my favour for a bit, until it reversed and closed as a pinbar reversal signal.

The "old me" would've kept the order open until my stop loss was hit, just below 0.9000. I then thought about it.

The pinbar formed along a trendline, as well within the 38.2-61.8% Fibonacci retracement level. The momentum of the last few weeks was also very bearish. To me, the probability of a successful trade became diminished. If 0.9000 was to be re-tested so soon, then it told me that institutional money was determined to break it.

Rather than wait for my stop loss to get hit, I saw an opportunity to cut my trade at a very cheap price, which I did. I then decided to trade the reversal.

I felt if institutional money was going to re-test 0.9000, it wasn't going to waste time. Rather than set my stop loss at the top of the pinbar, I moved it a bit lower in order to provide a 2:1 reward-to-risk ratio. I set my profit target a little above 0.9000. The trade closed in profit a short awhile ago so I'm pretty happy about how I traded this.