I learnt my lesson from my previous trade i.e. moving my entry beyond S/R when trading breakouts.

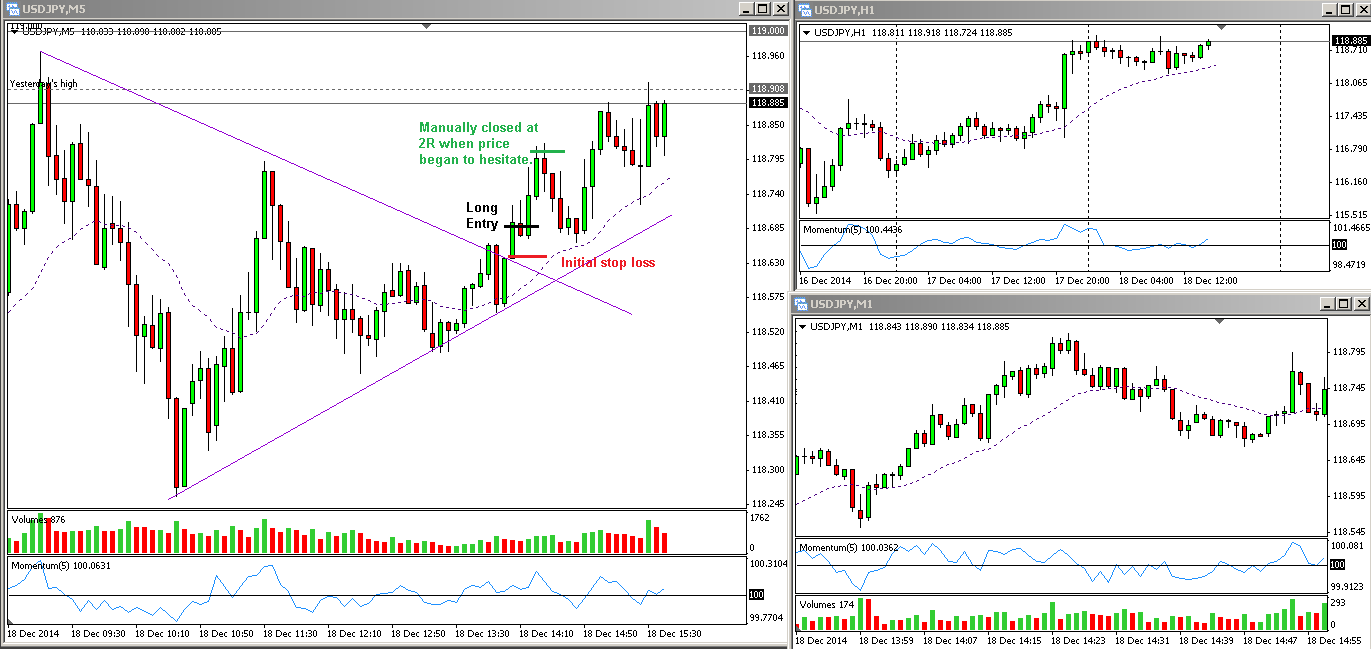

In this trade, I spotted a pennant forming on the USDJPY (purple lines = pennant formation). A pennant indicates falling volatility as price converges. However, price can't converge forever. At some point, price must make a decision on where it wants to go next. The break of the pennant usually indicates where price will go.

I went long on the break of the pennant's top side, but placed my entry a good distance away from the pennant itself. My stop loss was relatively tight since this was a breakout trade. I want price to decisively break upwards, or I'm out.

The breakout from the pennant itself was moderate. When price retraced a bit in the second candle, I moved my stop loss up to -0.5R. I'd set a profit target of 3R, but noticed that momentum was slowing down around 2R. I was trailing my stop loss, but decided to pocket 2R profit. If I had kept my trade open, my trailed stop loss would've been hit for 1.5R reward, so it was a good decision to get out.

(click to enlarge)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.