Hey everyone. I only put on a single trade this week, which I fumbled as I'll explain below.

NZDUSD

I'm not happy with this trade. Not happy at all.

Basically I saw a good bullish setup on the NZDUSD. According to my system, a reward-to-risk of 0.5R to 1R was ideal. I tended towards greed, and aimed for a 1R reward. My profit target was below the next resistance level, so I thought it was still reasonable.

(click to enlarge)

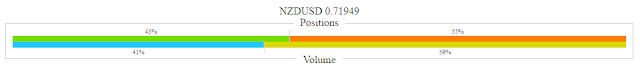

Retail sentiment was slightly bearish (55%), which tilted the odds towards a bullish breakout.

(click to enlarge)

Price did breakout in my favour, and reached 75% of my profit target. And then the European Central Bank statement came out for that day, causing the NZDUSD to tank. I wasn't aware of this until an hour later when I logged on, at which point I promptly closed the trade near breakeven.

Mistake #1 - Being away from the charts during a big news event

I was away from a live chart and didn't realise how big the reversal was until an hour after the ECB statement came out.

Mistake #2 - Being casual about big news events

I honestly didn't think the ECB would influence the NZDUSD that much. I need to be more mindful of central bank statements, as central banks are the biggest players in the forex market. Anything that can move the EURUSD can spill over onto other pairs as the EURUSD is the biggest currency pair in the world. Plus the ECB and the US Federal Reserve are the two biggest central banks in the world. Respect.

Mistake #3 - Not taking profit before a big news event

Price was between 0.5R and 0.75R before the ECB statement came out. It was within my profit-taking "green zone" for this particular system. My policy is to close profitable trades before big news, especially when it is near my profit target. But because I was away from the charts, I wasn't aware of the situation and didn't close the trade at a profit.

Mistake #4 - Being too greedy

While the reward of 1R was technically good, news events should be taken into consideration as well. Will my trade have enough time to reach its profit target before news comes out? If the answer's no, then a tighter profit target might be better (in this case, 0.5R to 0.75R).

My loss was very minor (-0.1R, or -0.15%), but it's the mismanagement of this trade that hurts more. It was pointless. I did have the option of keeping the trade open as it only fell back to breakeven, but I felt the psychological pain would be alot greater if the trade turned against me completely and hit my stop loss. I'll take the very small loss and consider it a cheap price for these lessons. :)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.