This week is full of important events - NFP is released this Friday, and four central banks will decide on interest rates.

USD

Last week's news has been mixed, but Federal Reserve chief Yellen made some hawkish noise, indicating that the next rate hike will depend on data.

24 Feb: CB Consumer confidence 96.4 vs 99.6 forecast - bearish

25 Feb: Yellen testimoney - rate hike dependent on jobs + inflation data - bullish

25 Feb: New home sales 481k vs 471k forecast - mildly bullish

26 Feb: CPI m/m -0.7% vs -0.6% forecast - mildly bearish

26 Feb: Core CPI m/m 0.2% vs 0.1% - mildly bullish

26 Feb: Unemployment claims 313k vs 288k forecast - bearish

27 Feb: Prelim GDP q/q: 2.2% vs 2.1% - mildly bullish

Overall news: Mildly bullish

Federal Resrve bias: Mildly hawkish

Outlook for this week: Mildly bullish

The biggest news item for this week will be NFP Friday. The last three NFP figures have beaten expectations, so another good number should send the USD soaring and strengthen probability of a rate hike.

EUR

The biggest EUR-related news has been the ongoing Greek drama. I'm still regarding the bailout extension as bearish for the EUR.

23 Feb: German IFO business climate 106.8 vs 107.4 forecast - mildly bearish

27 Feb: German prelim CPI m/m 0.9% vs 0.6% forecast - bullish

Whole week: Greek bailout extension - bearish

Overall news: Mildly bearish

Federal Resrve bias: Ultra-dovish

Outlook for this week: Bearish

The most important even for this week will be the ECB's interest rate decision on Thursday, March 5.

JPY

There were no major JPY events last week, and no major events for this week either. Very quiet for the JPY.

Overall news: Neutral

BoJ bias: Mildly dovish

Outlook for this week: Neutral

GBP

The Bank of England signaled some hawkishness last week, with Deputy Governor Shafik indicating the BoE's next move will most likely be an interest rate hike. I decided to upgrade the BoE's bias from marginally hawkish to mildly hawkish. Seems as if the BoE is preparing the market for an upward move.

24-25 Feb: BoE states confidence in bringing inflation to 2%, next move will likely be hike - bullish

26 Feb: Second estimate GDP q/q 0.5% vs 0.5% forecast - neutral

Overall news: Bullish

BoE bias: Mildly hawkish

Outlook for this week: Bullish

The BoE will decide on its interest rate on Thursday, March 5.

CAD

News has been somewhat bullish last week. BoC Governor Poloz said in a statement that its recent interest rate cut was insurance, but it wasn't the central bank's job to eliminate risk. I interpreted this as a hawkish statement, and that the BoC is in no hurry to reduce interest rates further.

24 Feb: BoC Governor Poloz hawkish statement - bullish

26 Feb: Core CPI m/m 0.2% vs 0.1% forecast - mildly bullish

Overall news: Bullish

BoC bias: Dovish

Outlook for this week: Neutral

The BoC will decide on interest rates on Wednesday, March 4.

AUD

No really major AUD news last week.

25 Feb: CNY HSBC Flash Manufacturing PMI 50.1 vs 49.6 forecast - mildly bullish

26 Feb: Private capital expenditure q/q -2.2% vs -1.7% forecast - bearish

Overall news: Mildly bearish

RBA bias: Dovish

Outlook for this week: Mildly bearish

The RBA will decide on interest rates on Tuesday, March 3.

NZD

NZD news has been very positive. RBNZ Governor Wheeler expressed concern about the NZ housing bubble on 25 Feb, which is a hawkish statement.

25 Feb: RBNZ Governor Wheeler statement on housing prices - bullish

25 Feb: Trade balance 56m vs -162m forecast - bullish

27 Feb: ANZ Business confidence 34.4 vs 30.4 forecast - bullish

Overall news: Bullish

RBNZ bias: Marginally hawkish

Outlook for this week: Bullish

There aren't many major news event for the NZD this week.

CHF

Nothing happening with the CHF. There were no major events last week, and none for this week as well. CHF will probably be quiet, with a bearish bias.

Overall news: Neutral

SNB bias: Dovish

Outlook for this week: Mildly bearish

MY CURRENCY PAIR WATCHLIST

Looking for longs: NZDCHF, GBPCHF, GBPAUD, USDCHF

Looking for shorts: EURGBP, EURNZD, AUDNZD, AUDUSD, EURUSD

Saturday, February 28, 2015

Friday, February 27, 2015

Opened - Short EURNZD

It's a few hours until the close of the NY session. The EURNZD looks set to close strongly bearish, so I've decided to go short.

NZD news has been bullish this week with RBNZ Gov. Wheeler showing concern about a housing bubble in New Zealand, and New Zealand posting a trade surplus of $56m (vs a forecast of -$162m loss). On the EUR side, Greece has accepted the conditions for a four-month bailout extension, but I'm still very much bearish on the EUR.

(click to enlarge)

Closed - Short EURGBP (opened 24 Feb 2015)

I took profit on my EURGBP short which was recently opened on the 24th of Feb.

I tightened my stop loss significantly after I saw a tiny bearish candle form on the 25th. To me, it looked like the market was at a tipping point, and price was either going to break down or rebound up and back into the range. Fortunately, price broke down and I got out with a reward of 2.75R (based on my tightened stop loss. With my original stop loss, it was close to 1R).

(click to enlarge)

As you probably noticed, I changed my charts a bit today. Instead of placing straight S/R lines, I've drawn boxes around each "segment" of price action. I noticed that each 'box' tells a chapter of the currency pair's story. When price moves out a box, the chapter ends and a new one begins. I think this ties in better with my fundamental analysis.

Tuesday, February 24, 2015

Opened - Short EURGBP

I went short on the EURGBP today after seeing a strong bearish candle poking below support. This trade is very similar to the GBPJPY long I opened today. My stop loss is set just above the lows of the last 10 days, as I expect these lows to behave as short-term resistance. The reward is 1.2R.

Price has been very hesitant over the last few weeks, but there is a slight bearishness. It seems as if the EURGBP wants to break down very soon, especially now that the Greek drama has been postponed for 4 months (I personally regard the bailout extension as bearish for the EUR).

(click to enlarge)

Opened - Long GBPJPY

My pending long on the GBPJPY got triggered today, when price poked above resistance. I set my stop loss just beneath the highs of the last 9 days. You know the old saying - old resistance becomes support (and vice versa). My reward is 1.25R.

Fundamentally, I am bullish GBP and bearish JPY, so this trade fitted my fundamental analysis.

(click to enlarge)

Saturday, February 21, 2015

Fundamental outlook for Feb 22 - Feb 28

As part of my fundamental analysis, I'll try to create weekly outlooks for each currency, combining news events with each central banks' bias. Ideally, we want to short currencies where the news has been bearish and the central bank dovish, and long currencies where news has been bullish and the central bank hawkish.

The best currency pairs to trade would be where one currency is bullish + hawkish, and the other currency bearish + dovish.

---

USD

The best currency pairs to trade would be where one currency is bullish + hawkish, and the other currency bearish + dovish.

---

USD

News over the last week has been mostly bearish. Of particular note was the dovish tone of the FOMC minutes that were released on 18 Feb.

18 Feb: Building permits 1.05m vs 1.08m forecast - mildly bearish

18 Feb: PPI m/m -0.8% vs -0.4% forecast - bearish

18 Feb: FOMC Meeting minutes - bearish

19 Feb: Unemployment claims 283k vs 293k forecast - bullish

19 Feb: Philly Fed Manufacturing Index 5.2 vs 8.8 forecast - bearish

Overall news: Bearish

Federal Reserve bias: Mildly hawkish

Outlook for this week: Neutral

The most important event this week is Federal Reserve Chairwoman Yellen's testimony on the 24th and 25th of Feb. Monthly CPI is also released on 26 Feb. I expect the USD to remain neutral unless Yellen makes some hawkish comments.

EUR

Looks like Greece will remain with the euro for now, after receiving a 4-month bailout extension. EUR news has also been bearish for all of last week.

17 Feb: German ZEW Economic Sentiment 53 vs 55.4 forecast - mildly bearish

20 Feb: French Flash Manufacturing PMI 47.7 vs 49.7 forecast - mildly bearish

20 Feb: German Flash Manufacturing PMI 50.9 vs 51.8 forecast - mildly bearish

21 Feb: Greece 4-month bailout extention - bearish

Overall news: Bearish

ECB bias: Ultra-dovish

Outlook for this week: Bearish

I'm anticipating that Greece's extension will be bearish for the EUR. ECB President Draghi will speak on 24th and 25th Feb, so we can expect major volatility during those days. Other news release during the week will probably be secondary.

JPY

JPY news has been mixed last week, but leans on the bearish side. GDP growth is below expectation, but Japan's trade balance has improved. The Bank of Japan issued a mildly optimistic economic forecast for Japan, but indicated it will continue QE for as long as necessary.

16 Feb: Prelim GDP q/q 0.6% vs 0.9% forecast - bearish

18 Feb: BoJ Monetary Statement - to continue QE for as long as necessary - mildly bearish

19 Feb: Trade balance -0.41T vs -0.95T forecast - bullish

Overall news: Mildly bearish

BOJ bias: Mildly dovish

Outlook for this week: Mildly bearish

No major news event for this week, although BoJ monetary policy meeting minutes come out on 23rd Feb. However, in the context of the BoJ's statement on the 18th of Feb, I don't think there'll be any surprises. The BoJ seem content to "carry on business as usual". Four medium-impact news items are scheduled for 27th of Feb so there could be some volatility that day. Otherwise I'm looking for JPY to break down this week.

GBP

GBP news has been mostly good. The Bank of England remains relatively dovish, however. The BOE revealed that all nine voting members voted to keep interest rates on hold during their last meeting. But there is speculation of an interest hike in mid-2016, so I am classifying the BOE as marginally hawkish.

17 Feb: CPI y/y 0.3% vs 0.3% forecast - neutral

18 Feb: Average Earnings Index 3m/y 2.1% vs 1.7% forecast - bullish

18 Feb: Claimant Count Change -38.6k vs -25.2k forecast - bullish

18 Feb: Bank of England votes 0-0-9 vs 0-0-9 forecast - mildly bearish

18 Feb: Retail Sales m/m -0.3% vs -0.1% forecast - mildly bearish

Overall news: Mildly bullish

BOE bias: Marginally hawkish

Outlook for this week: Mildly bullish

There isn't much major news coming out this week. A second estimate of quarterly GDP comes out on the 26th of Feb, although I believe it's influence will be muted. Overall, I would look for breakouts on the upside.

CAD

CAD news has been mixed. Sales figures are conflicting.

18 Feb: Wholesale Sales m/m 2.5% vs 0.4% forecast - bullish

20 Feb: Core Retail Sales m/m -2.3% vs -0.7% forecast - bearish

Overall news: Neutral

BOC bias: Dovish

Outlook for this week: Mildly bearish

I am leaning towards the bearish side. The Bank of Canada is dovish. In light of the mixed news, I don't see reason to be bullish.

There's a BoC speech scheduled on 24th Feb, and Core CPI m/m will be released on 26th Feb. I expect Poloz will use the speech to talk down the CAD.

AUD

Last week's been quiet for the AUD. The only item of note was the release of the RBA's minutes, where the RBA stated that the AUD was still "overvalued". The economic forecast remains positive, but is subdued.

17 Feb: RBA Meeting Minutes states AUD is "overvalued" - bearish

Overall news: Mildly bearish

RBA bias: Dovish

Outlook for this week: Mildly bearish

The AUD looks to be quiet this week as well. The only major news event is the release of quarterly Private Capital Expenditure on 26th Feb. The AUD will probably range, with a chance of a downside breakout.

NZD

NZD has mostly enjoyed favourable news last week. Dairy prices and retail sales have beaten expectations.

16 Feb: Retail sales q/q 1.7% vs 1.3% forecast - mildly bullish

17 Feb: GDT Price Index +10.1% - bullish

18 Feb: PPI Input q/q -0.4% vs -0.2% forecast - mildly bearish

Overall news: Mildly bullish

RBNZ bias: Marginally hawkish

Outlook for this week: Mildly bullish

NZD Trade Balance figures come out on the 25th Feb, and Business Confidence on 27th Feb. If positive figures come out, I believe the NZD will easily breakout on the upside. Bad figures will probably see the NZD retrace and consolidate.

CHF

A quiet week for the CHF. SNB chief Jordan held a speech on the 17th Feb, reaffirming that the SNB will continue to intervene in the forex market (presumably to devalue the CHF).

17 Feb: SNB Chairman Jordan speech - SNB will be active in forex market - bearish

Overall news: Bearish

SNB bias: Dovish

Outlook for this week: Bearish

There are no major CHF events this week. I expect a slow and steady CHF decline.

CURRENCY PAIRS ON MY WATCHLIST THIS WEEK

Looking for longs: GBPCHF, NZDCHF, and possibly GBPJPY, NZDJPY

Looking for shorts: EURGBP, EURNZD

Friday, February 20, 2015

Closed - Short EURNZD (opened 18 Feb 2015)

I closed my EURNZD at a small profit. Price isn't breaking down as strong as I wanted, and being Friday, I don't want to hold EUR positions over this particular weekend as the Greek drama continues. I'm still bearish on the EURNZD, but there's a high likelihood of major EUR news releases over the weekend while the market is closed. Risk management is #1.

Thursday, February 19, 2015

Live Call - Long NZDJPY (19 Feb 2015)

There was no change in the Bank of Japan's monetary policy yesterday. They are forecasting a moderate Japanese recovery, but the key takeaway is that they will continue JPY QE for as long as they have to. I saw this decision as mildly bearish for the JPY.

The overall news for the NZD has been bullish this week. Retail and dairy prices have beaten expectations and are up.

The price action on the NZDJPY is very bullish. There was a strong surge to resistance at 90.000, and a very weak pullback that formed a tiny inside bar that is less than 50% of ATR(5). Short-sellers at 90.000 weren't strong enough to push NZDJPY back down, which is a very bullish sign.

I'm looking to go long on the break of the 90.000.

(click to enlarge)

(click to enlarge)

I'm also quite bullish on the GBPJPY, but the price action on the NZDJPY seems more cleaner.

Wednesday, February 18, 2015

Opened - Short EURNZD

I opened this short on the EURNZD on Monday, when price broke through short-term support. I'm pretty confident with this trade. I tightened my stop loss, and set it above the short-term support level to improve my R:R ratio (reward for this trade is 1.5R). Fundamentals seem to be good. Good NZD retail figures came out on Monday, and the Greek crisis should continue to depress the euro.

(click to enlarge)

Closed - Long NZDJPY (opened 12 Feb 2015)

My long on the NZDJPY just hit it's profit target. Bullish news came out yesterday (NZD retail is up, JPY GDP is down), and it seems as if the bears gave up today. At the moment, price is at resistance at 90.00. I'll keep an eye on this level for the next few days and see how it reacts.

My profit target was 0.75R, which is low, but the setup didn't give me much room for a large reward.

My EURNZD short is still open, but it's not doing much.

Sunday, February 15, 2015

Live Call - Short EURNZD (16 Feb 2015)

I previously had a EURNZD short that I had exited some days ago after price found support. However, the reaction off this support level has been weak, and formed an inside bar on Friday's close. It seems as if the bulls have struggled to rally the EURNZD, so I'm looking to go short on the break of short-term support as marked below. My exit would be around the 1.50000-1.49000 area, giving me a reward of 1R. There are two major news releases tomorrow - NZD retail sales and another Eurogroup meeting.

Saturday, February 14, 2015

Closed - Short XAGUSD (opened 12 Feb 2015)

My short on silver got stopped out tonight during the European / US overlap. There didn't seem to be news behind the surge in silver's price, as far as I'm aware. Judging from the chart's price action, I expect silver to rise up to the $18.000 - $18.500 mark.

(click to enlarge)

Friday, February 13, 2015

Opened - Long NZDJPY

This setup barely satisfied my setup checklist. A significant pinbar formed on the NZDJPY today. NZDJPY fundamentals are bullish, but the technicals aren't perfect. The current trend is down, and there's a strong S/R level at 90.000. I've set my profit target a bit below at 89.500, giving me a reward of 0.75R. It's less than 1R, but a small reward will get me out of this counter-trend trade quickly. Like I said, it's not the best setup, but it satisfied my checklist. Because I'm feeling less confident, I've halved my position size, so if this trade fails, it's no big deal.

(click to enlarge)

Thursday, February 12, 2015

Opened - Short XAGUSD

I opened a short on silver (XAGUSD) this morning. As you can see in the chart below, silver's volatility has been shrinking over the last few days as it gyrates around a S/R level at 17.000, forming three consecutive inside bars. I went short on the close of the third inside bar after it satisfied my price action setup checklist. The technical setup aligned with my fundamental analysis (I'm bullish on USD).

My stop loss is just above the inside bars. Profit target is at 15.850, which would give me a profit of 2.2R.

(click to enlarge)

Closed - Long USDSGD (opened 9 Feb 2015)

I just closed my long on the USDSGD. Price broke upwards a few days after my entry, but today I saw a significant retracement that is heading straight back towards support. Rather than wait for price to fall back to support and reduce my profit to $0, I decided to take profit and see how price reacts at support. My profit was about 0.4R, which is small.

I was aiming for a reward of 1.2R. This was based on my projection of the next S/R level (if price is making new highs or lows and you're unsure where the S/R level will be, it'll usually be the same distance as the last S/R level).

(click to enlarge)

My plan is to see how price reacts at support. If I see a favourable reaction, I may go long again.

Wednesday, February 11, 2015

Closed - Long GBPJPY (opened 9 Feb 2015), Short EURNZD (opened 3 Feb 2015)

I just closed a long on the GBPJPY. My entry setup was your typical breakout retracement. Price broke through resistance around 180.000, then retraced a little, forming an inside bar. What got me really interested was that the inside bar couldn't break down through 180.000, confirming that support had been established. My own fundamental analysis showed a bullish bias for the GBPJPY. Technicals and fundamentals lined up, so I saw a good buying opportunity.

I went long on the close of the inside bar, with my stop loss 10 pips below the preceding candle's bottom. I took profit at 2R, about 70% of the way towards the next resistance level.

The GBPJPY still has plenty of scope to move upward, but I'll see how it reacts at the next resistance level.

edit:

I also just closed my EURNZD short. Price is hovering at a support level, which hasn't broke for nearly three days. The Eurogroup is meeting today, so it looks like a coin-flip to me. My profit was about 1R.

I went short on the close of the pinbar that appeared on 3 Feb. I was hoping to catch more profit, and exit near 1.50000, but the current choppy price action at support + major news today compelled me to get out.

I still have a long on the USDSGD, which is currently performing well.

Sunday, February 8, 2015

Live Call - Long USDSGD (6 Feb 2015)

I spent some time looking over the daily charts, and found three viable signals that are tradable: the AUDUSD, EURUSD and USDSGD. Using my current price action checklist, I found that the USDSGD scored the most points. This will be how I'll trade it on Monday:

I'll put a buy limit order just above 1.35000 (which has formed an intra-day S/R level on the H1 chart). Stop loss is just below the engulfing candle. I am aiming to take profit just below 1.37000. This would give me a reward of around 1.5R.

Technical Analysis

On the USDSGD chart, we see an engulfing candle bouncing off support and intersecting and closing above 1.35000 (a BRN or 'big round number'). Other technical strengths include:

- it's with the trend

- it's of significant size (1.5*ATR(5))

- the engulfing candle is twice the size of the preceding candle

- strong close (small wick on top)

Fundamental Analysis

Fundamentally, the Monetary Authority of Singapore is dovish, following an announcement to ease the appreciation of the SGD on 28 Jan. The Federal Reserve is marginally hawkish. The engulfing bar itself formed on the back of strong NFP figures from the US. Thus, the fundamentals to buy USDSGD line up.

Risk

The MAS may try to prevent the USDSGD from rising too fast. Price will have to break resistance above 1.35600.

Friday, February 6, 2015

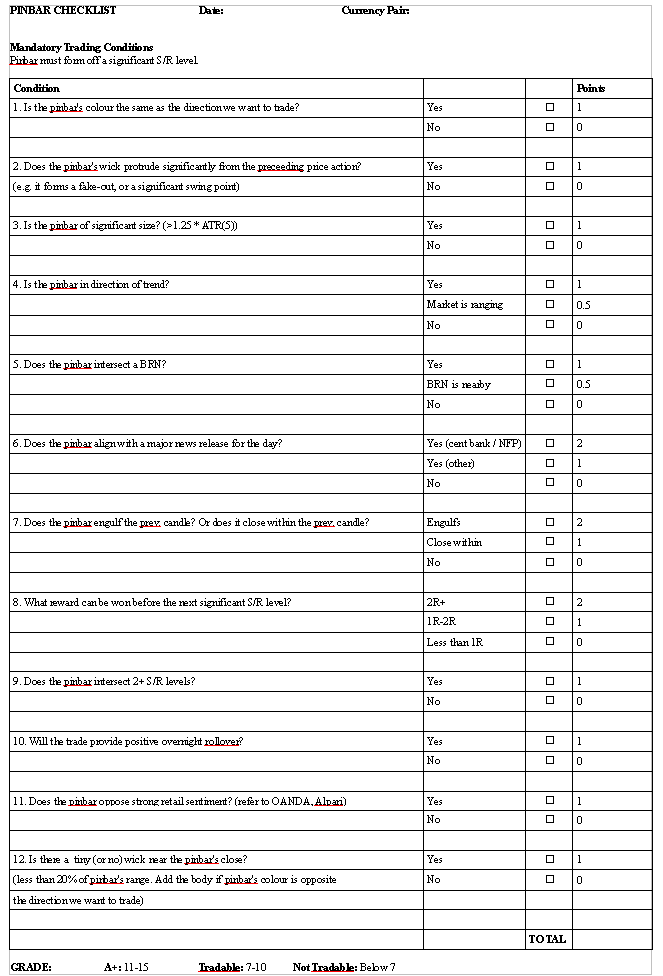

Pinbar Checklist

This is something that I've been working on for the last few days. I'm inclining to return to swing trading with price action, but this time incorporating fundamentals + sentiment into my trades. I produced the following checklist for the pinbar candlestick pattern. After ticking each question, you add up the 'points' to see if it's a high-quality setup or not. It's a work-in-progress, but I used it to enter a EURNZD short recently.

The EURNZD short (click to enlarge):

From my current checklist, this pinbar scored a 9 out of 15 (so it's tradable).

Hanging up the hat on day-trading (for now)

Another month has gone by, with no success with my day-trades. Transaction costs are simply insurmountable on the shorter timeframes. Last week was pretty bad, and I finished the month at breakeven.

After three months of day-trading, I'm going to shelve it for now, and switch my focus to swing trading. I'm disappointed. Major lessons:

- TRANSACTION COSTS! These kill profit. Badly. Reduce them as a % of your profit whenever possible (can be done by trading longer-term and aiming for bigger rewards).

- Day-trading is time intensive. This didn't bother me too much, but in the long-term, I'll probably miss out on doing other things with my life. The whole point of trading is freedom, right?

- S/R works on the lower timeframes. There's no such thing as 'noise', despite what some gurus say.

- The previous day's high and low are significant S/R levels. This may help with placing your entries and exits on the longer time-frames.

- Day-trading is more emotional. Opening and losing in minutes can psych you out and trigger revenge-trading.

- You miss out on positive overnight rollover (although you also avoid negative rollover; perfect for when you want to short the AUD or NZD).

Anyway, that's it for now.

Subscribe to:

Posts (Atom)