It's nearly 2am here. I'll post some interesting backtest results, then go to bed. Be warned, this is pretty complicated.

Just a brief background on tick volume. Since the forex market is decentralised, there's no way of measuring actual trading volume. The next alternative is to use tick volume, which approximates trading volume.

I've hacked together a custom indicator for MT4, which divides tick volume by a candle's range. So if tick volume for a candle was 200 ticks, and pip range was 10 pips, it would return a value of 20 (200 / 10 = 20).

Basically this would tell me how much "resistance" a candle faced as it formed. A high value would indicate high resistance, as it meant price required more ticks to move a pip.

Following from my first example, suppose we have another candle with 200 tick volume, but a range of 5 pips. 200 / 5 = 40. This is higher than the 20 we calculated in the first example. This shows that price faced much more "resistance" in this candle.

With this indicator, I can understand the context of tick volume better. To provide even better understanding, I also added a 6-period SMA to the indicator, giving me the average ticks / pips for the last 6 candles.

Getting on to the backtest, I examined the USDJPY and AUDUSD on the 1H timeframe, focusing on Tuesday, Wednesday and Thursday, as these days are usually best for daytrading (volatility on Mondays and Fridays tend to be lower).

I specifically looked for "low volatility" candles which had a range of less than 0.67 ATR(24), AND formed during a retracement of the trend (measured with RSI(24)), AND must have ticks / pips > SMA(6).

Basically, this signal is telling me that the retracement is ending, and we know this because price has slowed down (it has a range < 0.67 ATR(24)), AND we know that more orders have come in, as ticks / pips exceeds SMA(6). Less volatility + more orders = end of retracement. Example is below:

(click to enlarge)

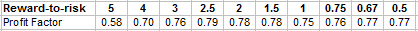

I backtested this signal from September 2013 to September 2015, with an entry at the break of the candle's high or low, in the direction of the trend, and a stop loss at the opposite end. I gathered 359 trades, and obtained the profit factors for the following reward-to-risk ratios:

The profit factors are quite slim. Transaction costs really hurt at this timeframe, eating up about 10% of each trade. That's a significant penalty.

I put together an equity curve for a reward-to-risk of 1.25, using a starting balance of $25,000, with 2% risk per trade, and 10% transaction cost.

It's not the best looking curve, but it's pointing in the right direction. Under real trading conditions, I don't think I'd just blindly aim for 1.25R reward with every trade. I'd see if there's any significant S/R or price levels before entering. Looking from the backtest results, rewards between 1R and 2R seem best.

The next step is to see if this behaviour holds on other pairs. I chose the USDJPY and AUDUSD as their volatility is generally consistent throughout the day. I'll test the NZDUSD, and then the EURUSD.

Until then...

EDIT:

You can find a ticks / pips indicator for MT4 here.