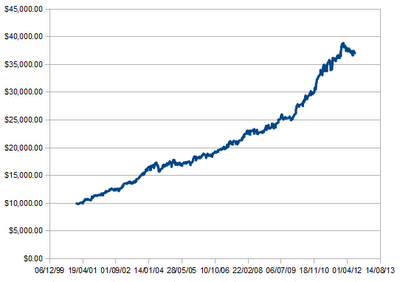

I've been quietly working on this trading system for a few weeks now. My first-round backtesting was finished today and the system is looking very profitable.

It's a low volatility breakout system, based on the weekly timeframe.

My backtest details:

Years tested: 2001 to mid 2012

Pairs tested: EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, USDCHF, EURJPY, NZDUSD, GBPJPY, AUDJPY, NZDJPY

Timeframe: 1W

Sample trades collected: 403

Profit factor: 2.49

There are no indicators involved. I initially backtested using ATR to measure volatility, but didn't find it useful in this timeframe. I then merely measured changes in volatility by comparing the current week's range with the previous week. If it's less than 50%, we have an entry signal.

We look for entry signals over the weekend after the trading week is over. We then place pending orders that will last for all of next week.

Entry signal: At the close of the week, the week's range must be less than 50% of last week's range. On Monday morning when the markets open, we place a pending long at the high of the week + 1 pip, and a pending short on the low of the week - 1 pip. The orders should be set to expire at the end of next week.

Stop loss: If going long, the low of the week - 1 pip. If going short, the high of the week + 1 pip.

Take profit: 25% of your stop loss

Some people may raise their eye brows at the level of the take-profit. At this level, our reward-to-risk is 0.25:1, which is a little unconventional. But I cannot deny my backtest results. This is one of the best R:R ratios to use. All R:R ratios are profitable, but 0.25:1 R:R almost maximises my profit factor, up to 2.49, which I think is very good for a mechanical system with little optimisation.

Here's a graphical example of a trade:

Everything about this system is preliminary at the moment. I would like to further optimise but even at this stage, the system is tradable. My main concern is the relatively small sample size of 400 trades, although it has been tested 10+ years across all the majors and Yen crosses. The high profit factor makes this alluring.