How should we trade the breakout of a range? These are some possibilities that I've thought of.

All the following strategies assume that we expect a breakout on the upside, and therefore want to go long.

Strategy 1 - Buy at Resistance

We buy at the range's resistance. At resistance, I believe that the 'big money' may exploit the liquidity offered by sellers, and take the opposite side to fill their buy orders. It seems counter-intuitive, but if buyers aren't able to fill enough of their orders along the range's support level, their only alternative is to buy at resistance.

If price moves to resistance and doesn't move down, and we see alot of tick activity within a narrow candle, that's usually a sign of 'big money' buyers buying from sellers. Once there are no more sellers left, we have a breakout.

To trade this strategy, we may buy at resistance, with a tight stop loss along the middle of the range. We expect resistance to break quickly, or we are out at the first sign of failure.

Pros:

- Little trade management or decision making required. The trade either moves in our favour quickly, or we are out.

- Tight stop loss can give us a good reward:risk ratio.

- Can move stop loss to breakeven if there's a fakeout.

- Stop loss is not at an obvious place (in the middle of the range. Most stop losses will be located outside the range)

- We are trading with near-term momentum.

Cons:

- Can get chopped out if the battle between bulls and bears becomes volatile.

- Requires careful timing and observation.

- A long-lasting range can mean many losses.

Strategy 2 - Buy at Support

We buy at the range's support. We know there will be a glut of buy limit orders from the 'big money' at support, causing price to return back into the range. Buying here puts us in sync with the majority of buyers.

We can spot a possible entry signal by zooming into a lower time frame and looking for a change in momentum.

To trade this strategy, we buy at support, with our stop loss below the support level. As price bounces off support and into the range's resistance level, we have some options:

a) Move our stop loss to breakeven and hope that resistance will break.

b) Take profit if there's no breakout and price is staying within the range.

c) Take profit if there's a fakeout and price has returned back into the range.

d) Trade the breakout if it's successful.

Pros:

- We have some flexibility. We can move our stop loss to breakeven as we watch how price reacts to the range's resistance level. If we don't like the reaction, we can close our trade for a small profit.

- If resistance breaks but we experience a fakeout, we can still close the trade for a small profit.

- Since we bought at support, a large portion of the range gets added to our reward. This provides a better reward:risk ratio than all other strategies here.

- A long-lasting range may result in many breakeven or slightly-profitable trades, unlike strategy 1.

- A buy limit entry can result in positive slippage (bigger reward, better reward:risk ratio).

Cons:

- Stop loss is at an obvious place (below support), so you may fall victim to stop hunts.

- Near-term momentum is against us.

Strategy 3 - Buy at Breakout

We place a buy stop just above resistance. If the range's resistance level breaks, we buy at the first opportunity and hope to catch the ride upwards.

Buy stops from breakout traders, and stop losses from range traders will accumulate beyond the resistance level. Once resistance breaks, these stops will be triggered, usually resulting in a large and quick surge upwards. We want to be in when this occurs as breakouts can be very large and lucrative.

To trade this scenario, we place a buy stop above resistance, with our stop loss below resistance. We simply wait for resistance to break and trigger our order.

Pros:

- The simplest strategy of all. We buy as price rockets upwards.

- We can trade all breakouts, even those that do not retrace (refer to strategy 4).

- We aren't harmed by long-lasting ranges.

Cons:

- Slippage can be significant, especially during the breakout. Our reward:risk ratio can be harmed.

- We miss out on the reward from entering the bottom of the range (strategy 2)

- We will most likely lose from fakeouts (during a fakeout, price won't rise sufficiently to allow us to move our stop loss to breakeven).

Strategy 4 - Buy at Retracement of Breakout

We wait for the breakout to occur, and then buy during a retracement back to the range's resistance level (which is now turned into support).

Breakout traders whose orders went unfilled may wait for price to fall back to the range's resistance level, and then buy again. Short-sellers who sold at resistance may also exit here at breakeven. Both groups of traders will create bullish pressure, resulting in the end of the retracement, and the resumption of the breakout.

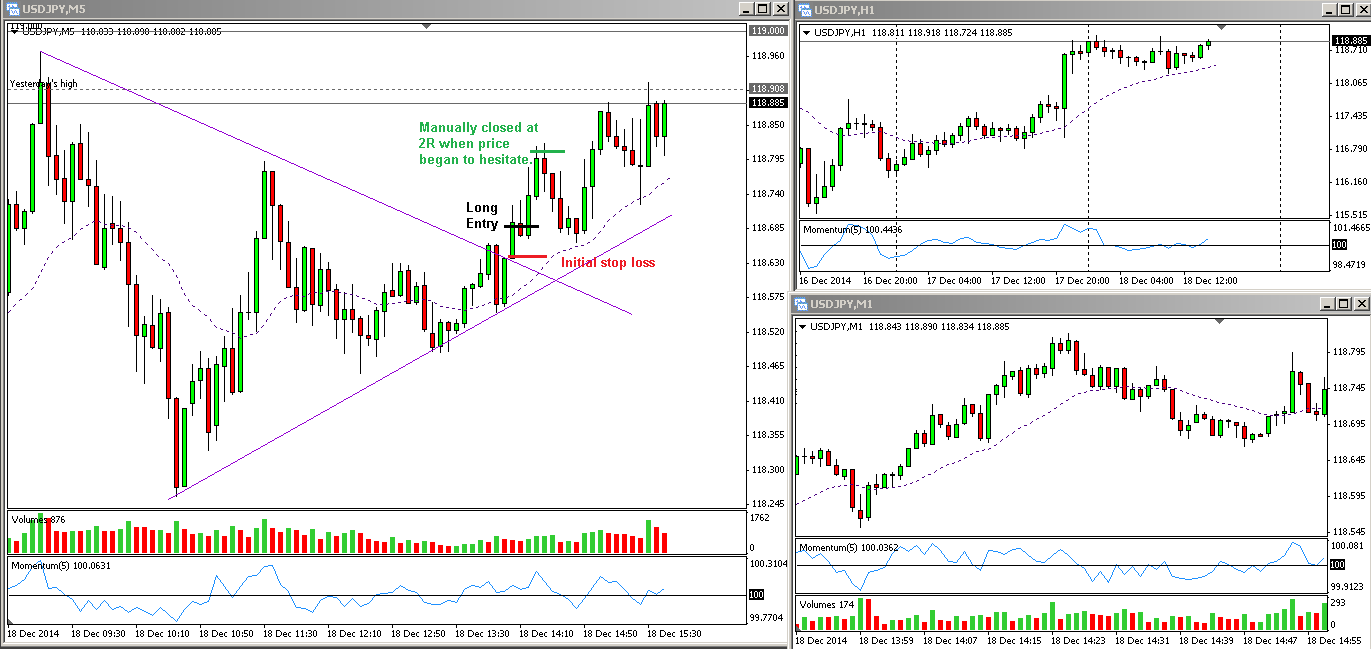

We can spot a possible entry signal by zooming into a lower time frame and looking for a change in momentum as price approaches the range's resistance.

To trade this strategy, we buy above resistance after the breakout has occurred, and begun retracing. Our stop loss should be below resistance.

Pros:

- Low slippage (or positive slippage if using a buy limit order).

- The retracement will tend to be more calm than the breakout, giving us more time to assess price action.

- We will have the opportunity to detect fakeouts and avoid entering.

- We aren't harmed by long-lasting ranges.

Cons:

- We miss out on breakouts that don't retrace (these are the most lucrative).

- It can be difficult to detect the difference between a retracement and a fakeout.

- We miss out on the reward from entering the bottom of the range (refer to strategy 2)

- Near-term momentum is against us.

- If we do enter during a fakeout, we will most certainly lose (no chance to move stop loss to breakeven).

Which strategy is best?

I examined each strategy based on the following: Reward Size, Win Probability, Simplicity and Flexibility. I mainly used my gut-feel, although some answers should be obvious.

Reward Size

1. Buy at Support (we catch the breakout + most of the range as well. We can also profit from failed breakouts and range-bound trades)

2. Buy at Resistance

3. Buy at Retracement of Breakout

4. Buy at Breakout (worst reward size due to slippage)

Win Probability

1. Buy at Support (assuming support holds when we enter, most trades should be at least breakeven)

2. Buy at Retracement of Breakout (can avoid some fakeouts)

3. Buy at Breakout (can't avoid fakeouts)

4. Buy at Resistance (will lose to range-bound trades and any fakeouts where SL hasn't been moved to breakeven)

Simplicity

1. Buy at Breakout (set order and forget)

2. Buy at Support (need to ID entry signal)

3. Buy at Resistance (need to ID entry signal)

4. Buy at Retracement of Breakout (need to differentiate between a retracement and fakeout - can be difficult)

Flexibility

1. Buy at Support (we can move stop loss to breakeven, exit all range-bound trades or fakeouts at a small profit, and trade a successful breakout)

2. Buy at Resistance (can still move stop loss to breakeven during some fakeouts)

3. Buy at Retracement of Breakout (we have the chance to identify a fakeout and stay out)

4. Buy at Breakout (no choice at all)

Conclusion

It seems to me that buying at the range's support level is the best move. We increase our reward substantially, we are buying where the 'big money' is most likely buying, we can watch how price reacts at the range's resistance level, and we can profit from range-bound trades, fakeouts and breakouts.