Myfxbook

Trades: 7

Account growth: 0.44%September has been very quiet. I normally open 10+ trades per month, but during September, I only opened seven. I was more selective about my trades this month, mainly because of the loss I endured during August.

I limited my risk to 0.5%, up to a maximum of 1% for a few trades. I believe if I had been more aggressive with my risk, I probably would've grown my account by 1% for the month. That's the price you pay for being conservative.

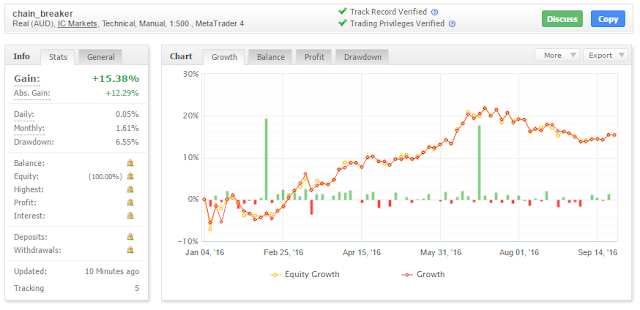

I also reached my 100th trade milestone this month. A snapshot of my trading account is below (click to enlarge):

My profit factor is currently 1.31, which is on par with my backtests.

RESEARCH

I've devoted September to researching ranging markets, with limited success. I've developed a range breakout system, although I'm not 100% happy with it. This is a backtest equity curve from 239 sample trades, from 2012 to 2016:

My main concern is how "lumpy" my wins are. I'd prefer to see a more even distribution of wins and losses. I'll continue my research in October.

NEXT MONTH

My current drawdown is still over 5%, so I'll keep my risk to 1% per trade during October. Once my drawdown falls below 5%, I can ramp up my risk to 1.5%-2%.