Time to review 2015.

Overall, I finished the year up 18.77%. A large chunk of that growth occurred in the last few months when I began trading the majors exclusively.

These are the results of ALL trades, including minors and exotics.

All Trades (Majors, Minors and Exotics)

Trades taken: 112

Equity growth: 18.77%

Maximum drawdown: 10.55%

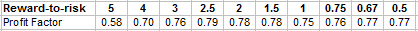

Average reward-to-risk: 1.06

Win rate: 57.14%

Profit factor: 1.26

And these are the results of trades involving the MAJOR pairs only.

Majors Only

Trades taken: 30

Equity growth: 17.46%

Maximum drawdown: 8.12%

Average reward-to-risk: 1.04

Win rate: 73.33%

Profit factor: 2.32

Of the 18.77% growth, 17.46% came from trading the majors. Basically, the bulk of my profit came from trading the major pairs.

It should be noted that I only opened 30 major-pair trades, which is a relatively small sample size.

Here's the final equity curve (I've kept the y-axis confidential for privacy):

Major developments this year

Dropping the minors and exotics

I re-examined my trading journal a few months ago and found that the bulk of my profit came from trading the major pairs. I've been trading the majors exclusively since then and experienced significant success. I also revisited my backtests and found my systems performed better with the majors vs the minors and exotics.

Development of nine trading systems

This year, I developed nine technical systems to trade on the daily and weekly timeframes. Alot of these systems are based on older systems that I used to trade, but have been updated or modified.

I can't daytrade

This isn't really a development, but my experiments with daytrading ended with failure. I just can't do it!

Surviving January 15, 2015

This was the day when the SNB (Swiss National Bank) depegged the Swiss franc from the euro. Many accounts were blown up. I had a live position on the CHFSGD but escaped, losing a few % of my account. Lessons a) use a stop loss (although it didn't help everyone) b) avoid pegged currencies c) don't deposit all of your equity with a single broker (only deposit enough to provide margin).

Meeting up with other traders

I finally met up with a few traders in real life! Retail trading is a lonely career, so I think it's important to branch out and meet other traders.

Goals for 2016

Capital raising

Basically gather more money to trade with. This means more hours at work and leveraging my profits. I hope to make 2016 the year of the Big Push.

Improving the quality of my trades

This will be an ongoing process. I'll remain mindful of news and nearby S/R levels when determining my trades, and focus on the majors exclusively.

Opening a myfxbook account

I plan to open a myfxbook account early in 2016 so everyone can follow my results live.

Professionalise my blog

I'm still treating this blog as a personal diary, but if 2016 is successful, I plan to make my blog much more professional.

That's a wrap. Good luck in 2016, traders!