Hey everyone, here's my performance review for 2016!

RESULTS

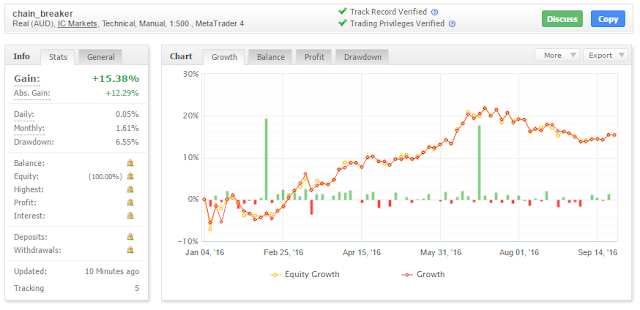

This year I made a return of 15.3%. Most of that was made during the first seven months of 2016, which was then followed by slow, gradual drawdown which has thankfully stabilised over the last few months.

Trades taken: 121

Equity growth: 15.3%

Maximum drawdown: 8.61%

Average risk per trade: 1.18%

Profit factor: 1.26

My results from 2015...

Trades taken: 112

Equity growth: 18.77%

Maximum drawdown: 10.55%

Average risk per trade: 1.96%

Profit factor: 1.26

Yeah, my profit factor for 2015 and 2016 are exactly the same. It's not a typo.

Here's my equity curve from both 2015 and 2016:

2015 - 2016

(click to enlarge)

Take note of the linear regression line, and how R^2 is 0.89. This is from real world results. That is beautiful. If you're wondering why the first half of the equity curve looks more volatile, it's because I traded with higher risk in 2015 (average 1.96% per trade), while in 2016, my risk was nearly half, at an average of 1.18% per trade.

Major developments for 2016

I'm officially a trader

It's time to officially call myself a trader. After half a decade of learning and two years of consistent live trading, I've assembled a very good equity curve that I'm very proud of. That's real, hard cash that I've extracted from the market by myself. It's all real.

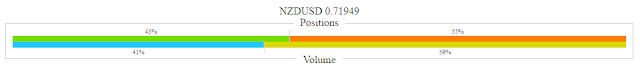

Myfxbook

At the start of the year, I opened a public Myfxbook account that I've maintained throughout 2016. It's been an interesting experience, but after a year, I no longer see much upside in continuing the account. I've noticed myself becoming anxious with people watching my trading account. What do I get out of it? I've considered trading other people's money and using Myfxbook to attract investors, but in the end, I feel better trading for myself only. It'd be nice (and lucrative) to trade other people's money, but there's alot of legal and psychological obstacles to overcome that can only erode my edge. And for me, trading is about freedom. So I plan to turn the account to private early next year.

Goals for 2017

Plugging leaks

At this point, it's no longer about finding the "perfect" trading system. It's about finding and plugging all the leaks that erode my edge - physical, mental, financial, psychological etc. I'm taking inventory of everything. If it harms me, I'm letting it go.

Reduce work hours?

If I can maintain my trading results, I can look at reducing my working hours in my RL job. That's the dream of all traders, right? :) At the least, I've got options. I have one foot out of the rat race already. It's a very good place to be. :)

And that's that! A profitable year is a good year.