Seasoned traders should already know this. Suppose you're given two systems with the same profit factor, but one uses a reward-to-risk of 2-to-1, while the other is 0.67-to-1.

Which system is better? Hopefully you'll answer the 0.67-to-1, even though most "gurus" suggest 2-to-1 or even greater. Why?

Both systems have the same profit factor. But this doesn't automatically mean that they behave the same. Systems with higher R:R ratios tend to suffer a drop in win rates. If you're losing more often, what does this mean? Yep, you're encountering drawdown more often.

To illustrate this point, I'll compare two systems that I've developed.

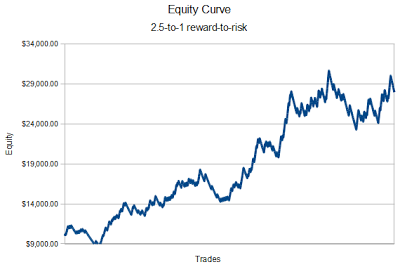

System A has a profit factor of 1.2, and uses a reward-to-risk of 2.5-to-1. Here is its equity curve, assuming a risk level of 1% equity per trade.

Here is System B's equity curve, using the same level of risk (1%). System B has a lower profit factor, being 1.13, but it uses a reward-to-risk of 0.67-to-1.

Looking at the final result of each chart, it's clear that system A is more profitable. But doesn't the equity curve for system B look more linear as it progresses to the right? This is a good thing, as we want our equity curve to be as upwardly linear as possible (perfect linearity would suggest zero drawdown).

The maximum drawdown for system A was 24% while system B had 13%. It seems counter-intuitive to think that a system with a higher profit factor can have greater drawdown. While drawdown is influenced by your risk level (% equity per trade), it is also affected by your R:R ratio. A higher R:R ratio will usually result in more losses "clumping" together, leading to a higher drawdown.

My beliefs are that a 1-to-1 reward-to-risk will be most ideal, although I'm prepared to accept 2.5-to-1 all the way down to 0.25-to-1. I'll try to choose an R:R ratio within this range that'll provide the highest profit factor.

If you must trade extremely large R:R ratios, or follow trends with a trailing stop, I think it's best to risk a smaller amount of your equity to counter the "clumpiness" of your losses and reduce your drawdown.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.