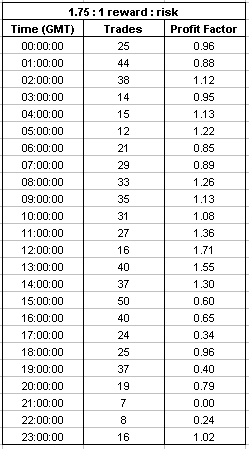

I spent some more time on my backtest, and sorted my trades by the hour. This is what I came up with.

You can see that the profit factor exceeds 1 between 08:00 GMT and 14:00 GMT. This roughly covers the Tokyo / London overlap, the London session and the first half of the London / NY overlap. The system tanks towards the end of the London / NY overlap (traders leaving the market, I guess) and the NY session itself. During the Asian session, the system seems to be at breakeven, which I found surprising. I had expected better performance.

I've tested 15 months worth of data, and have 30 more months left. I'm doing the backtest manually, as in analysing every candle on the 1H chart. It's very time consuming. I don't expect my backtest to finish until mid-January, at this rate. However, my sample size is big enough to make me confident to forward-test this system live (with minimum risk, of course).

Hello,

ReplyDeleteIt's a very nice post.Thanks for posting such an informative blog.Really nice ideas are their.

Thanks once again .

Forex currency traders software