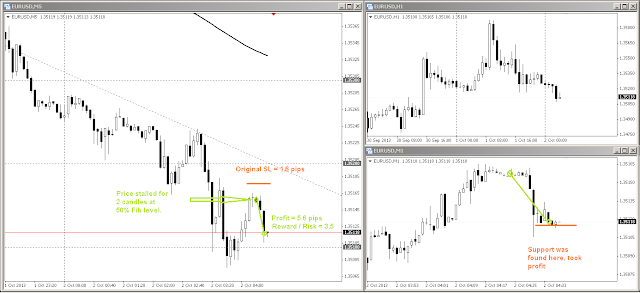

Original SL = 1.6 pips

Final TP = 5.6 pips

Reward / Risk = 3.5

Transaction costs = 0.7 pips

Net profit = 5.6 - 0.7 = 4.9 pips

I felt the above setup presented a good asymmetrical opportunity to trade with the trend, especially after two small, neutral-ish candles appeared. My stop loss was tight as I entered near the top of the turn. The market was either going to turn downward here, or shoot up. I originally aimed for 4R, but took profit at 3.5R when the downward price movement stalled for five minutes (refer to M1 chart in bottom right). Why risk 3.5R for an additional 0.5R?

Nice Trade. Glad to see you're keeping everything in one place.

ReplyDeleteThx mate!

ReplyDelete