This is a continuation of the post RESEARCH: Monday morning breakouts on the USDJPY and AUDJPY.

In my previous post, I found that "average-sized" candles tended to signal profitable breakouts on the AUDJPY and USDJPY during Monday morning.

The next step was to check if this pattern continued in other currency pairs, especially Asian ones. I backtested the AUDUSD, NZDUSD, AUDNZD and USDSGD from 2013 to 2015.

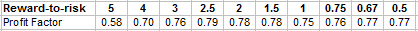

Here the results from 405 sample trades (this includes the AUDJPY and USDJPY):

Yep, nothing. The profit factor was less than 1 for all R:R ratios, so the pattern didn't hold.

Further findings

I used RSI(6) to measure the trend. This indicator tells me the "trendiness" of the last 6 candles. If RSI(6) > 50, then the trend for the last 6 candles is bullish. And if RSI(6) < 50, the last 6 candles have been bearish.

I divided my results further into two groups: trades that opened WITH the trend, and trades that opened AGAINST the trend.

Results WITH the trend (215 sample trades):

Results AGAINST the trend (190 sample trades):

Interestingly, trading AGAINST the trend yielded pretty good results. It may have something to do with the unique dynamics of Monday opens. However, my gut-feeling is that this backtest has become too finely-tuned. My next step is to step back and look at Monday opens from another angle (perhaps by looking at candlestick patterns).

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.